Financial Wellness Begins with Awareness

Budgeting commonly seems like a task-- up until you recognize it's your very first step toward freedom. Whether you're a young professional attempting to construct your initial reserve or a moms and dad preparation for college tuition, grasping your money starts with comprehending it. And that begins with awareness.

Beginning by tracking every buck. Not simply the lease and the groceries, but also that coffee run, the spontaneous movie evening, the streaming registrations. It's not regarding sense of guilt-- it's concerning clearness. You can't change what you can't see. When you ultimately see your behaviors theoretically, you'll realize where your budget takes a breath and where it stifles.

Build a Budget That Reflects Your Life

A budget is not one-size-fits-all. It's personal. It needs to reflect not simply your revenue and expenses, however your values, your way of life, and your objectives. Some individuals fit with spread sheets; others favor budgeting applications or perhaps the old envelope system. Pick a method that matches your habits-- not somebody else's.

If you're just getting started, a basic 50/30/20 guideline can aid:

- 50% of your income approaches needs

- 30% towards desires

- 20% towards financial savings or financial debt benefit

Yet that's only a beginning point. Some months will be leaner, others extra flexible. Your budget plan ought to develop with your life.

And do not neglect to pay yourself first. Even a little month-to-month contribution to your personal savings account develops momentum. Gradually, it comes to be a habit, not a hurdle.

Saving Doesn't Mean Sacrificing Joy

It's a myth that saving money indicates surrendering every little thing you enjoy. Smart savers learn how to make room for pleasure and stability. Intend to travel more? Set up an automated transfer to a traveling cost savings pot every month. Looking at a new phone? Budget for it in time instead of taking out the plastic on impulse.

Several members find success by opening up different savings accounts for particular go right here goals. A personal savings account for emergencies, a second one for getaways, a 3rd for holiday presents. It maintains your objectives arranged and your progression noticeable. Enjoying your balance grow-- even gradually-- is encouraging.

Utilize the Right Tools for Financial Growth

Your cash must work for you, not the other way around. That's why it pays to use the right financial devices-- like high interest checking accounts that benefit your balance, or low-fee options that do not eat into your financial savings.

Not all accounts are developed equal. Some checking accounts now supply returns that rival typical savings accounts, specifically when you meet specific monthly requirements like straight deposit or a set number of transactions. These high interest checking accounts transform day-to-day investing into an easy development chance-- no added initiative called for.

Similarly, credit union credit cards commonly included lower interest rates, less charges, and member-focused perks. They're made with your monetary health in mind, not simply the bottom line of a major banks. If you're building or reconstructing credit scores, utilizing your card sensibly-- and paying it off in full monthly-- can substantially boost your score with time.

Long-Term Planning Starts in your home

Thinking about the future? Whether you're imagining a brand-new location to call your own or aiming to refinance, home mortgages can appear daunting in the beginning. However they don't need to be. With the guidance of economists who prioritize your benefit, navigating the procedure comes to be less difficult.

The secret is prep work. Prior to requesting a home mortgage, recognize your credit score, your debt-to-income proportion, and just how much residence you can truly pay for-- not just based on what you're authorized for, yet what fits your budget pleasantly.

And remember, a home loan isn't simply a car loan-- it's a path to possession, safety and security, and a more powerful financial future.

Make Saving Automatic-- And Emotional

Among the easiest methods to stay consistent with your cost savings objectives is to automate them. Set up recurring transfers right into your personal interest-bearing account each payday-- prior to you even see the money in your checking account. Think about it as paying your future self.

Yet conserving isn't nearly technicians-- it's psychological. It's regarding really feeling protected when emergencies hit. It's about giving your future self options, freedom, and peace of mind. Money can not acquire joy, but it can purchase stability. And that's an invaluable investment.

Credit History Isn't the Enemy-- It's a Tool

Credit rating obtains a bum rap. Yet used sensibly, it can be one of your most effective devices for building economic toughness. From funding major acquisitions to leveraging lending institution charge card for rewards and ease, credit report uses adaptability-- if you appreciate its power.

Stay disciplined. Establish alerts to advise you of repayment due dates. Maintain your usage reduced-- ideally under 30% of your complete offered credit score. And prevent applying for numerous lines of credit in a brief amount of time. Responsible credit history usage opens doors-- literally, if you're considering home mortgages.

Financial Growth Is a Journey, Not a Destination

Your finances will certainly change over time. You'll have seasons of saving and periods of costs. That's regular. The trick is consistency, education and learning, and a desire to adapt. Make time each month to sign in with your cash. Evaluation your budget plan. Celebrate your victories-- large or little.

And when problems take place (they will), do not obtain prevented. Every mistake is a lesson. Every bounce-back constructs strength.

Your local credit union can be a partner in this trip-- not just a company. Whether you're maximizing high interest checking accounts, exploring home mortgages, looking for lending institution credit cards, or nurturing your personal savings account, bear in mind: you're not the only one.

Keep tuned for more practical suggestions, real-life stories, and expert advice right here on our blog. Return often-- your economic future is entitled to the focus.

Patrick Renna Then & Now!

Patrick Renna Then & Now! Judge Reinhold Then & Now!

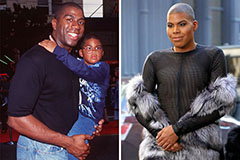

Judge Reinhold Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!